Newsletter #9 – Market in Correction

Keep on reading to learn more about all these exciting stuff:

- Back into a correction after economic activity indicates that stimuli has not created lasting improvements

- The market just got a confirmed Hindenburg Omen, which significantly increases the likelihood of a stock market crash

- Housing market is really starts to impresses on the downside – again

- Nothing new with the US economy, it is still extremely weak; moving towards a broken back

- Bonds at record low yields, is it time to exit?

- As always some people view the stock market as extremely cheap, so should you maybe put your money there?

- USD is headed for a great run relative to most other currencies

- Gold looks like it could break to the downside, but still not confirmed

- Pretty close to 1929

- Talking about 1929 that was the start of long period if deflation, what is the current status on inflation vs. deflation?

- Hey, by the way, did I mention that the US will go bankrupt?

- China is heading towards trouble as well

- And finally, as always: These are my current main thoughts on our outlook

Back into a correction after economic activity indicates that stimuli has not created lasting improvements

With yesterdays market action all my main indicators have now turned negative and the market is now in an official correction. The first indicators started turning negative a few weeks ago, but the uncertainty that we have seen in the market for months now has continued after we saw the first indications that a correction might be around the corner.

But now it is official and it does not look promising for the coming months. You don’t wont to be long stock in this environment. So make sure to make proper adjustments to your portfolio, and do it quickly. That the market now entered into a new correction is never a proof that a crash will come, but it makes it much more likely. And remember that stocks take their time going up, but when they head down, they do so quickly and violently.

I believe that there is a very high likelihood that we have entered into stage two of a very long bear market that started back in 2007. And I also think that this “double dip” will make indexes go significantly lower than the levels of March 2009. But be aware that there will probably be many strong corrective rallies on the markets way down.

A report that came out yesterday showed that housing fell to its lowest level since 1995 as Existing Home Sales fell 27.2% in July vs. June. This in part confirms, what I talked about in the previous letter, that the recovery was just a result of government stimuli and would probably retract as soon as stimuli levels were scaled back. It is anyway a sign of a very unhealthy economy.

When the market takes a beating, it’s natural to look for reasons. In addition to the bad housing report from yesterday there has been plenty of bad news coming out lately. Market watchers pointed to the Federal Reserve’s uncertainty about the U.S. economic recovery, a report of slower growth in China, Britain’s central bank cutting its growth forecast, a rise in America’s trade deficit and a report from the International Energy Agency that saw “significant” risks to the global recovery.

But you are better off not speculating on why the market’s acting as it is. Stay focused on how the market is acting instead. The search for the “why” can lead you astray. Often those who think they have pinpointed the exact reason for a sell-off are then tempted to argue with the market. That’s a dangerous stance to take. Yesterday’s market action was decisively negative. Institutional investors were clearly unloading stocks, and you don’t want to be owning any stocks in such an environment.

But instead of spending too much time here in the intro let’s rather get into the facts so you can figure out how to make some money in this market. And it might be big money to be made this fall. That is was this is all about, making sure to make money no matter the direction of the market – and even more importantly, independently of what kind of doomed to fail policy our politicians decide to try out next.

The market just got a confirmed Hindenburg Omen, which significantly increases the likelihood of a stock market crash

We got a third official Hindenburg Omen (H.O.) observation yesterday. The first observation happened on August 12th, 2010. There only needs to be two observations to form a cluster that raises the probability of a coming stock market plunge from random on any given day (less than one-tenth of one percent), to thirty percent for a crash over a coming four month period, and over 75 percent for a significant decline to occur over the coming four months. H.O.s are very rare and this last confirmed cluster of H.O.s is only the second one since 2008, which of course led to the massive stock market crash in the autumn 2008. Before that it also called the decline of 2007. Research done by Mr. McHugh (www.technicalindicatorindex.com) shows that a stock market crash can occur as soon as the next day, or as far into the future as four months. There have only been 27 confirmed H.O.s over the past 25 years.

The Hindenburg Omens tells us much the same as the number of 90% panic buying and panic selling days that we have kept counting lately, but it is an indicator that is a little more complicated and cumbersome to calculate. We now have fourteen 90 percent panic selling down days and ten 90 percent panic buying up days since the April 26th top. A Hindenburg Omen is an indicator comprising of several different rules, one of which is looking at the number of stocks making new 52 weeks highs vs. the number of stocks making a new 52 week lows on the same day.

Peter Eliades explains the thoughts behind the indicator this way in his Daily Update, September 21, 2005 (www.stockcycles.com), “The rationale behind the indicator is that, under normal conditions, either a substantial number of stocks establish new annual highs or a large number set new lows – but not both.” When both new highs and new lows are large, “it indicates the market is undergoing a period of extreme divergence – many stocks establishing new highs and many setting new lows as well. Such divergence is not usually conducive to future rising prices. A healthy market requires some semblance of internal uniformity, and it doesn’t matter what direction that uniformity takes. Many new highs and very few lows is obviously bullish, but so is a great many new lows accompanied by few or no new highs. This is the condition that leads to important market bottoms.”

The huge uncertainty in the market can also be observed by the chart at the end of this newsletter that shows the frequent shifts in market correction over the last few months.

Furthermore, all three major US indexes have now sliced through both their 200- and 50-daymoving averages.

Also remember that many important tops have occurred in the month of August, with the sweet spot of declines occurring after an initial mild drop in August, the headline drops coming typically in the September to October period. This year could be another example of this sort of bear market action.

High-frequency traders with computerized trading models now account for 70% of market volume. What happens when these people start trading less? I will let you answer that your question for yourself.

Several indicators are now pointing to a massive drop in GDP coming shortly. The ECRI, which has a 100% accuracy rate for predicting recessions has just posted its fastest collapse in history and is already at levels indicating another recession is a “sure thing.” In plain terms, the ECRI chart indicates that we are heading into a recession that will be on par with that which occurred in 2001… and this is unemployment already at 9.5% (if not higher) and private sector GDP having barely staged a bounce!

Housing market is really starts to impresses on the downside – again

Sales of previously built single-family homes plunged in July to their lowest level since May 1995 as job fears trumped today’s low mortgage interest rates and relatively affordable home prices. The sales of existing single-family homes, condominiums and townhouses fell to a seasonally adjusted annual rate of 3.83 million, the National Association of Realtors reported Tuesday. That’s a 27.2 percent drop from June, about twice as much as analysts surveyed by Bloomberg expected. That’s also a 25.5 percent drop from the same time a year ago. I don’t believe there is any chance that the economy will turn around without the housing market. This reminds me of something that Greenspan said back in 2008. Take a look at this: “Whenever home prices do stabilize the end of the credit crisis will be right around the corner. Stable home prices will clarify the level of equity in homes, the ultimate collateral support for much of the financial world’s mortgage backed securities. We won’t really know the market value of the asset side of the banking system’s balance sheet, and hence banks’ capital, until then.” Alan Greenspan said that in August 2008.

The economy will probably not see any upswing either with a house market moving in this direction. Imagine the impact this will have on the banks… (this probably explains why the bank index has performed so poorly lately). Wonder how many banks will go bankrupt in 2011.

Nothing new with the US economy, it is still extremely weak; moving towards a broken back

I know I have been shouting watch out for a while now and I will continue shouting it until the underlying economic conditions actually shows sign of improvement. As I am sure that you all are fully aware of by now, I have never had any belief in the “recovery” as it has fully seemed to be a result of the record high stimulus that has been pumped into the economy around the world, and that it would not be able to create any lasting improvements.

In my mind it is exceptionally ignorant to believe that you can fix a systemic economic problem by giving money to banks, helping people buy new cars and new houses. This does nothing to fix the real problem that we are facing. And as much as we hope that if we buy ourselves a little time, the problem will fix itself, I don’t believe it will. The main problem is that we have too much debt, way too much debt, and that the US it heading towards bankruptcy if it does not do a MAJOR change. We have become a society that does not use debt as a tool for short term financing; we have become addicted to debt to grow our whole economy. We have a government with too high costs running continues almost non-stop budget deficits for decades, which off course does nothing else than add on more debt, and we have future obligations that there is not a living chance that can be met. These are just a dew of the problems we face. If the US continues the way that they have done under Busch and Obama it will go bankrupt very very soon. We as a society have to accept that we are not a growing economy anymore (at least not at the same rate that we used to be), and that we need to live a life with other expectations than what we have been used to. Our population is growing older, and we can’t afford to take care of them with a ratio of taxpayers continuously falling in the western world.

We have also learned recently that the U.S. Trade Deficit widened a dramatic 18.8% in the month of June 2010 to USD 49.9 billion, which is a sign that the economic policies of the government are an abject failure. The Fed more or less said the same thing in their interest rate decision and commentary, admitting they need to monetize U.S. debt and buy long-term U.S. Bonds, because the economy in effect stinks.

On Thursday Aug 12th, the usually upbeat CEO John Chambers of Cisco Systems warned of “unusual uncertainty” in the economy.

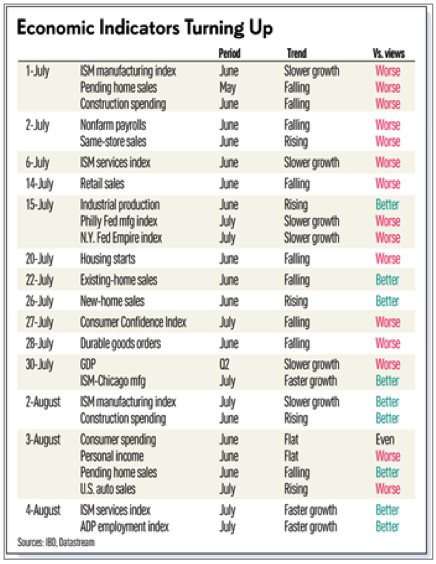

As you can see from this charts, which is a few weeks old, but still relevant, most economic indicators are coming in weaker than expected. Never a good sign.

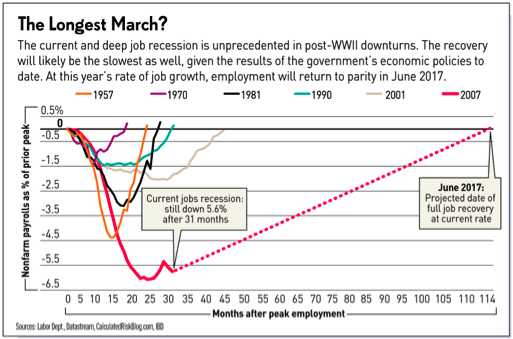

Remember that we did not just see another “recession” in 2008 and 2009. It was extremely severe, and most consumers have not seen too much of it – yet. This is how it compares since other recessions since 1957. If you believe that we will start recovering now, we might be back to where we started in terms of unemployment in June 2017! 7 years away. And it probably wont go the way that the projections show, but much slower. Well, I believe that unemployment will continue to rise over the next years. So back to parity maybe not until 2025, if we ever really get back to the level of 2007…

So where should you hide you money? Are bonds the way to go?

Bonds at record low yields, is it time to exit?

The yield on the U.S. 30-year Treasury Bond plunged to 3.57% yesterday, and the odds are very high that the decline is fast approaching an end. It could have more to go in the short-term, but long term you want to stay far away from T-bonds. The US is going bankrupt, remember. The trader optimism toward U.S. Treasury Bonds has soared to 98% bulls via the Daily Sentiment Index (trade-futures.com). The only higher percentage of bulls was the all-time record extreme of 99% bond bulls, which occurred on December 16, 2008, two trading days prior to the all-time high. After a four month the recent higher gap open could be an exhaustion gap. Even though Treasury debt should hold up much better relative to lower-grade debt, when optimism reaches its zenith, the probabilities strongly favor a countertrend move, at the least.

Bond traders have quietly bought the 2-year note until yields reached their lowest level ever; more than at any point during the Panic of ’08, more than during the “flash crash” on May 6. Never in the 234-year history of the Republic has the US government been able to borrow money for two years at less than half a percent 0.497%, to be exact. Likewise, never have global investors had such paltry choices that these measly returns look like a good bet. Just as remarkable: Even with money so cheap, lending and mortgage activity in the U.S. activity continues to look anemic at best, moribund at worst. – “If investors expected the Fed to raise rates at any time in the next two years,” bond king Bill Gross explained to The New York Times, “the yield would be much higher.” And the Fed would only keep rates so low if a deflationary threat still loomed.

As always some people view the stock market as extremely cheap, so should you maybe put your money there?

One of those people is Charles Lieberman of Advisors Capital Management: “Earnings are strong, stronger than expectations and revising earnings upwards. No other ways to invest your money, because bond rates are too low. S&P 500 companies have USD 1 trillion in cash. JP Morgan was forced by its accountants to take money out of its reserves because they meant that they had too much capital there. Stocks are now very very cheap, the cheapest they have been in the last 40 years.”

I totally disagree and would short his funds if I could. First of all, we just entered into a correction and then you should definitely not put any money what so ever on the long side of the stock market, in addition, if you believe the economic situation is worsening, like I do, the last place you want to put you money is in the stock market. Instead of putting money into stock I think that the smartest investors will head towards the USD over the coming months.

USD is headed for a great run relative to most other currencies

It is probably time to move back into the USD again. I am very bullish on this currency vs. all other major currencies for the rest of the year. It was recently fewer than 6% bulls (DSI via trade-futures.com). This is fewer than it was at the November 2009 bottom when it was 7% USD bulls. Not that this alone is a good enough indicator or timing tool to find a new bottom. But I believe that the current correction in the market will be strong and swift and move increasingly risk averse market operators into the short-term safety of the USD. I am saying short-term safety of the USD because longer-term (5 to 15 years) the USD still looks like it could end up being totally worthless relative to real assets.

A lot of people expect the Fed to start its Quantitative Easing again and that will have a very negative effect on the USD. I am in no such belief. Well, they might start QE, but I think that the urge for safety will be stronger than the fright for the negative long-term impact that QE will have on the USD. So the USD us most likely going to start a new ascent and I think it will go higher than its previous 2010 top

Gold looks like it could break to the downside, but still not confirmed

Gold broke down below its lower boundary of a trend channel that goes all the way back to October 2008. This is a bearish sign. If gold continues to fall it could easily fall to somewhere between 680 (low in October 2008) and 1050 (low in January 2010). It could also be that the coming fall in the stock market will bring with it “the last man standing”. The last man standing is off course gold, which has managed as one of the very few asset classes to avoid a major correction throughout and since the financial crisis. It is very hard to say were gold will head from here, but be cautious and don’t bet that it will be the safe heaven that it have proved to be up until now.

Pretty close to 1929

Likewise, beginning in the summer of 1930, a severe drought ravaged the agricultural heartland of the USA. By mid-1930, interest rates had dropped to low levels. But expected deflation and the continuing reluctance of people to borrow meant that consumer spending and investment were depressed. By May 1930, automobile sales had declined to below the levels of 1928. Prices in general began to decline, although wages held steady in 1930; but then a deflationary spiral started in 1931. This short description from the Great Depression is not even close to giving a representative picture of what happened back then, but I was doing some research about the GP for the book I am writing and I got a little surprised by the close resemblance of that situation back then to what we have seen now. Remember that the market bounced significantly after the initial crash of 1929 before the market continued its bear market run until 1933.

Talking about 1929 that was the start of long period if deflation, what is the current status on inflation vs. deflation?

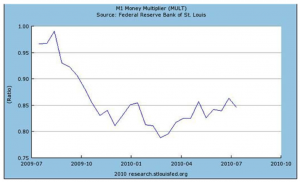

There’s a strong monetary force at work opposing inflation right now: the weak M1 money multiplier. When the Federal Reserve wants to stimulate the economy, it pumps money into the banking system and then banks typically lend out more than they receive. Today, however, many banks are in danger of failing so the government has required them to increase their reserves. Additionally, many banks view loaning money to businesses and consumers as a very risky activity right now. As a result, banks have not lent out all the new money they have been getting from the Fed. When banks lend less money, the M-1 money multiplier drops below 1 and there’s no expansionary effect on the economy. For a number of decades, the ratio has been far above 1. Right now the ratio is 0.846, which is about the same as the last the last few months. Banks still are not lending. The St. Louis Federal Reserve publishes a graph that shows the M1 money multiplier. For reference, the multiplier was above 3 in the late 1980s. It declined slowly to about 1.6 in late 2008. Between late 2008 and early 2009, the ratio dropped from about 1.6 to below 1 in a matter of weeks. In the graph below, you can see how it’s stayed below 1 for more than a year now.

See newsletter #8 for the longer-term chart.

Hey, by the way, did I mention that the US will go bankrupt?

I keep repeating this, and the reason is because I don’t think people get the severity of the situation, but the U.S. is heading in full speed towards bankruptcy. And it is not that far away. Neither spending more nor taxing less will help the country pay its bills. Last month, the International Monetary Fund released its annual review of U.S. economic policy. Its summary contained these bland words about U.S. fiscal policy: “Directors welcomed the authorities’ commitment to fiscal stabilization, but noted that a larger than budgeted adjustment would be required to stabilize debt-to-GDP.” But in the same document the IMF has effectively pronounced the U.S. bankrupt. Section 6 of the July 2010 Selected Issues Paper says: “The U.S. fiscal gap associated with today’s federal fiscal policy is huge for plausible discount rates.” It adds that “closing the fiscal gap requires a permanent annual fiscal adjustment equal to about 14 percent of U.S. GDP.” The fiscal gap is the value today (the present value) of the difference between projected spending (including servicing official debt) and projected revenue in all future years.

Laurence J. Kotlikoff, a professor of economics at Boston University, helps us put this into perspective through a column in Bloomberg on August 11th, 2010. “To put 14 percent of gross domestic product in perspective, current federal revenue totals 14.9 percent of GDP. So the IMF is saying that closing the U.S. fiscal gap, from the revenue side, requires, roughly speaking, an immediate and permanent doubling of our personal-income, corporate and federal taxes as well as the payroll levy set down in the Federal Insurance Contribution Act. Such a tax hike would leave the U.S. running a surplus equal to 5 percent of GDP this year, rather than a 9 percent deficit. So the IMF is really saying the U.S. needs to run a huge surplus now and for many years to come to pay for the spending that is scheduled. It’s also saying the longer the country waits to make tough fiscal adjustments, the more painful they will be.”

I have also earlier been pointing out the huge unfunded liabilities and all the “off balance sheet” debt that the US government has. Mr. Kotlikoff also has a take on this but his numbers are even more depressing than what I have presented earlier: “Based on the CBO’s data, I calculate a fiscal gap of $202 trillion, which is more than 15 times the official debt.”

The reason for this discrepancy is due to the enormous costs related to the 78 million baby boomers that when fully retired, which is just around the corner, will collect benefits form Social Security (of which money our government has spent instead on saving on our behalves), Medicare and Medicaid. The annual costs of these programs will be USD 4 trillion 20 years from now when measured in current dollars. That is about 25% of current GDP.

There is absolutely no way that this scheme can go on for long. It will end in misery. Either through the US going bankrupt, being bailed out by China, or that the USD collapses and becomes absolutely worthless compared to anything with intrinsic value (hyperinflation).

China is heading towards trouble as well

I am also extremely bearish on China. I think the fall in the Chinese market might be even worse that the US market. Those guys over in China have done a lot of good things, but also a lot of bad ones. While you might think that the US spent a lot of money on stimulus, then take a look at how much the Chinese spent. During the first half of 2009 the Chinese government injected a stimulus equivalent to 64% of their first half 2008 GDP!!

This money did as expected not find itself into to many constructive long lasting ventures but instead into all type of asset classes pumping up their prices. Not a good way to rebuild an economy. And especially an economy that was and still is the fastest growing economy in the world. Offical government statistics say that housing prices in China have risen between 12 and 15% over the last year in the largest cities. People in China don’t reqognize these numbers and say that the actual number is probably much closer to 40 to 60%. Expect this market to correct significantly as the global economy weakens.

About ewmoe:

2 Responses to “Newsletter #9 – Market in Correction”

Leave a Reply

Wow this is a great resource.. I’m enjoying it.. good article

Great info! I recently came across your blog and have been reading along. I thought I would leave my first comment. I don’t know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often.