Newsletter #1, 2011: Market in DOWNTREND – What we can learn from Japan

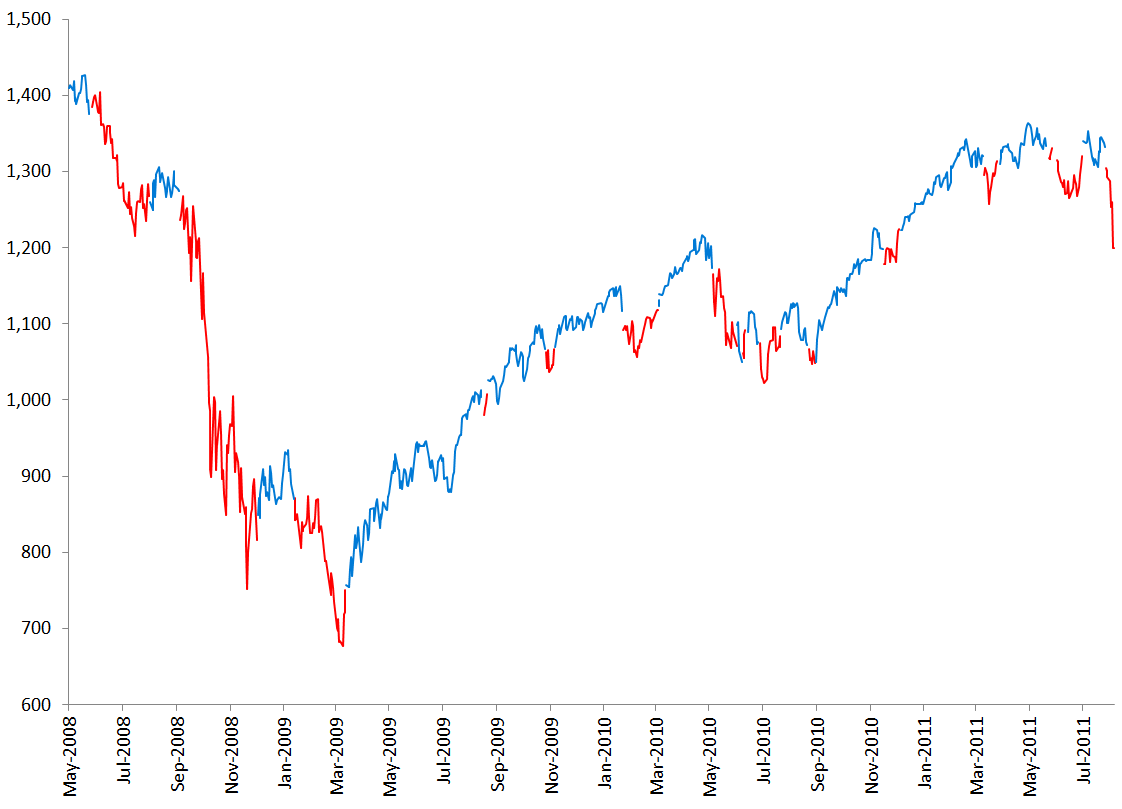

You have not heard from me in a while now and that is because we have been in a continuous uptrend since December 7th last year when I sent out my last newsletter. After more than three months of uptrend the market entered a new DOWNTREND as of the close of Thursday March 11th. I sent out my short notice the next day and this is finally the follow up newsletter.

We will cover the following topics in today’s newsletter:

- The newsletter is finally taking its first small baby steps into the www

- A new downtrend and what it means

- Emerging Markets gives indication of were we are heading

- We have just witnessed the fastest doubling in the S&P 500 since 1936! But then see what happened next…

- If the US was to see a repetition of 1937/38, maybe Japan could be a good place to put your money right now?

- Japan might or might not be nice investment, but more importantly we have so much to learn from the Japanese

- Everybody seems to be bullish on everything right now

- The US housing market does not provide any supportive arguments for taking a positive stance regarding the future

Newsletter #12, 2010 – Market in uptrend from Tuesday December 7th, 2010

Today we have the current gloomy topics that we will dive into:

- Optimism reaches new highs – Not a sign of an ending bear market

- Spain will soon be needing a bailout as well

- In the US, as I have stated so often that everybody probably have heard me screaming wolf for several months now, the situation is not any better

- We know what the Fed has been doing lately, but it is more interesting to see what they are actually saying

- Copper as a stock market indicator

- “Don’t touch my junk” – How US initiatives for increased safety leads to more death

Newsletter #11, 2010 – Market in correction from Wednesday November 17th, 2010

I have limited the number of topics in today’s issue and made it into a little story for a change:

- We are in a correction, but finally we had an uptrend that lasted more than a week

- Business leaders are positive to the US and global economy…

- …but the Fed and its disastrous last policy show signs of desperation…,

- …with likely implications being those of a currency war – the fight for being the cheapest of the lot

Newsletter #10 – Market in Uptrend

A pretty short addition this time, but it does contain some extremely important information like:

- More (dark?) omens have been observed in the market over the past week

- There is always something we can learn from history – a small study of the crash of 1987 and 2008

Newsletter #9 – Market in Correction

Keep on reading to learn more about all these exciting stuff:

- Back into a correction after economic activity indicates that stimuli has not created lasting improvements

- The market just got a confirmed Hindenburg Omen, which significantly increases the likelihood of a stock market crash

- Housing market is really starts to impresses on the downside – again

- Nothing new with the US economy, it is still extremely weak; moving towards a broken back

- Bonds at record low yields, is it time to exit?

- As always some people view the stock market as extremely cheap, so should you maybe put your money there?

- USD is headed for a great run relative to most other currencies

- Gold looks like it could break to the downside, but still not confirmed

- Pretty close to 1929

- Talking about 1929 that was the start of long period if deflation, what is the current status on inflation vs. deflation?

- Hey, by the way, did I mention that the US will go bankrupt?

- China is heading towards trouble as well

- And finally, as always: These are my current main thoughts on our outlook