Newsletter #1, 2011: Market in DOWNTREND – What we can learn from Japan

You have not heard from me in a while now and that is because we have been in a continuous uptrend since December 7th last year when I sent out my last newsletter. After more than three months of uptrend the market entered a new DOWNTREND as of the close of Thursday March 11th. I sent out my short notice the next day and this is finally the follow up newsletter.

We will cover the following topics in today’s newsletter:

- The newsletter is finally taking its first small baby steps into the www

- A new downtrend and what it means

- Emerging Markets gives indication of were we are heading

- We have just witnessed the fastest doubling in the S&P 500 since 1936! But then see what happened next…

- If the US was to see a repetition of 1937/38, maybe Japan could be a good place to put your money right now?

- Japan might or might not be nice investment, but more importantly we have so much to learn from the Japanese

- Everybody seems to be bullish on everything right now

- The US housing market does not provide any supportive arguments for taking a positive stance regarding the future

The newsletter is finally taking its first small baby steps into the www

Before I get going on this newsletter I first of all want welcome you to my new web page: www.ewmoe.com. After sending out this newsletter for nearly three years I found out that it was about time to take it online. I hope you will like this better than the old emails. I have realized that I am anything but an internet wiz so this web page did not come about without some extensive help from three good friends; David Vega, Dennis Steinmeijer and Moulsari Jain, big thanks to all of you for making this happen!

There are still a lot of improvements (mostly content wise which is my responsibility) that can be made to this website. Comments, tips and feedback are as always more than welcomed! Send me an email at newsletter@ewmoe.com or leave your comments in the comment fields at the bottom of each newsletter or blog post.

A new downtrend and what it means

The reason why you have not seen a new newsletter from me in a while is not because I have been too occupied with other stuff, like writing my book, it is rather because I only send out these newsletters when there is a change in market direction: Going from uptrend to downtrend and when going from downtrend to uptrend.

Since I sent out my first newsletter on May 28, 2008 we have had an average length of each move of 46 days. Last year was a little more volatile with an average length of a month. The last uptrend that ended last Thursday lasted for 94 days, which is the second longest run of any move since initiation of the newsletter. I was very pleased to see that volatility, and hence uncertainty, had decreased for a while, actually since September last year. But we have seen a change to that with all the recent turmoil.

The market doesn’t like uncertainty and there’s plenty of it around the world right now. Aside from Japan’s disasters (earth quakes, tsunami and nuclear), violence continues in Libya, and tensions increased in Bahrain. We are also seeing a build up of tension in Saudi Arabia. Meanwhile, sovereign debt worries in euro zone countries have rekindled.

The models I use to indicate the turning points in the markets are based purely on technicals, and not on any of the recent news, and especially not on what direction that economists, strategist or other self-proclaimed oracles think that the market will take (if they have any weighing in at all it is as contrarian indicators). Indirectly however these events and opinions have an impact on investor sentiment and it is this result that can be observed by studying the right technical indicators, which also feeds into my models determining the direction of the market.

There has been an increase of heavy selling over the last few weeks, which accumulated with a 90% panic selling day on Thursday March 10th. This also marked the final drop that made all my indicators point to a market in a downtrend.

There is no way of knowing how long a downtrend will last. Past downtrends have lasted from 6 days to 91 days with an average length of 33 days. Instead of guessing on length and depth, remember that when the market is in a downtrend it’s best to avoid buying stocks until the market improves. Be patient and wait until more of the risk is taken off the table, when a new uptrend is confirmed. Also, make sure that none of your winning positions from the last uptrend turn into losses.

We have been in an extended uptrend since March 2009. I, as I have stated more than a thousand times now it seems, still think this is a bear market rally. Let a new uptrend prove itself before you buy aggressively again. Now, defense should be No. 1. You don’t have to dump stocks en masse, but lean on the side of protecting your capital. With the current long-term uptrend at the two-year mark, bear in mind that historically the market has a tougher time making gains after the first two years of a bull market following a major decline. Even if you regard this as an abnormal bull market, it’s prudent to keep your expectations in check. That can be a struggle. It’s only natural after big gains in 2009 and 2010 to become bold. Erring on the side of caution is wise after the big money has been made, even if you weren’t the one making the big money.

Emerging Markets gives indication of were we are heading

Emerging Markets (EMs) have led the S&P on every major turn over the last four years. EMs have now broken below the trendline that sustained them from the 2008 lows. The fact that this trendline has held for more than two years indicates that was is happening in the market right now is significant.

The US markets broke through its most recent trendlines on March 11th, falling below the February 24th lows, signaling that a new multi-week downtrend might have started. Although the indexes have advanced in five of the past six sessions, volume was below average on most of those days. Yesterday, the S&P 500 joined the NYSE composite above the 50-day moving average (DMA). The Nasdaq is still below that key area. A rise above the February 18th, 2011 12,392 high would confirm that a multi-week rise was underway, likely toward 13,000 or higher. The next major support to the downside is at the 1,225 level in the S&P 500. The iShares MSCI Emerging Markets Index closed above its 50 DMA yesterday as well, but also here volume was low. I mentioned Copper as an indicator in the previous newsletter

We are now at a juncture were the market could turn to an uptrend pretty soon, watch index action around key resistance areas, don’t forget to see check the volume, and keep an eye on Emerging Markets.

We have just witnessed the fastest doubling in the S&P 500 since 1936! But then see what happened next…

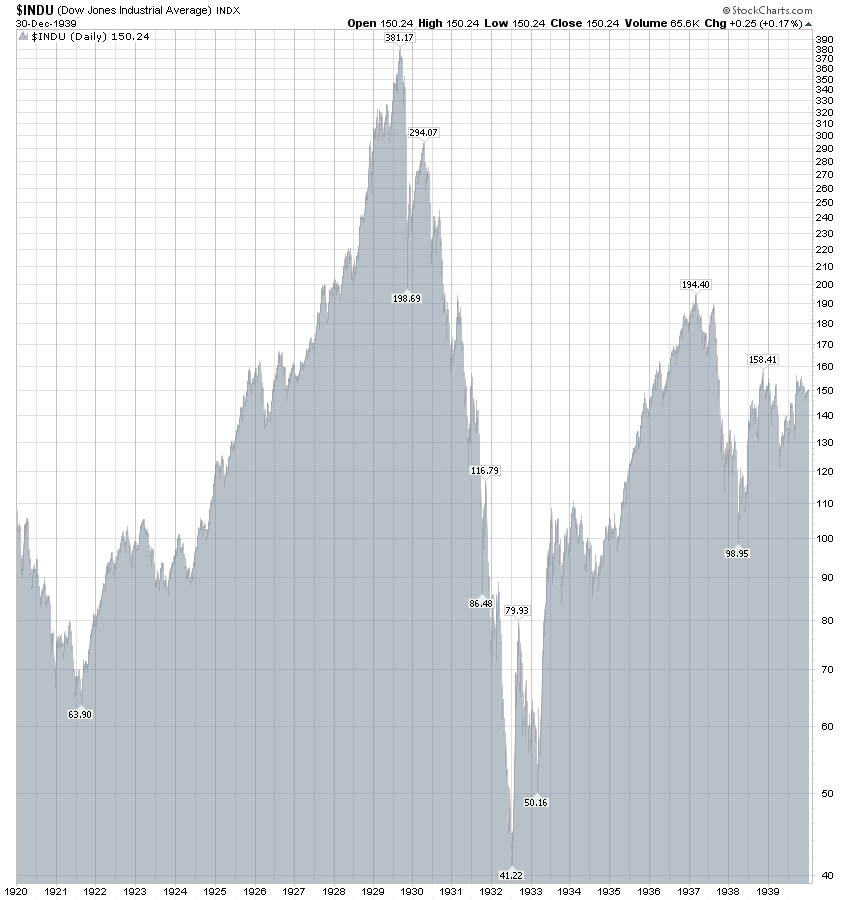

Lots of other interesting stuff has happened during the last three months since the last newsletter. One of those events is a rare one: A doubling of the S&P 500. As of Feb 14th, the S&P 500 had doubled from its March 2009 low, the infamous 666. It took the index just 707 days to achieve this, which is the fastest doubling of a major US index since 1936. Back then it took the Dow just 501 days according to the Wall Street Journal.

Don’t ask me how they came to this conclusion because to me it looks like it happened much faster than that, but anyway, that is irrelevant for what is to follow. Because it is much more interesting to see what happened after 1936:

- The Dow topped out in March 1937

- It then pulled back and came about 5% of that top again in August 1937

- Then it tanked again, and by March 1938 it was back at the level it had been three years prior

In the 1930s as now the government spent a lot of money trying to prop up the economy. Back then it was called the New Deal, now it has more names and abbreviations than there are letters in the alphabet. Anyway, by 1938 the effect of the massive New Deal programs that had been implemented between 1933 and 1936 had lost its effect and the proof was written in the pudding. The economy was not able to grow without massive government stimuli. Anyone seeing any similarities with today’s situation?

Henry Morgenthau, Jr., the late 1930s equivalent of Timothy Franz Geithner, had a something to say about the situation that could be helpful for us today. In the 1937 “Depression within the Depression,” Morgenthau was unable to persuade Roosevelt to desist from continued deficit spending. Roosevelt continued to push for more spending, and Morgenthau promoted a balanced budget. On November 10, 1937, Morgenthau gave a speech to the Academy of Political Science at New York’s Hotel Astor, in which he noted that the Depression had required deficit spending, but that the government needed to cut spending to revive the economy. In his speech, he said:

“We want to see private business expand. … We believe that one of the most important ways of achieving these ends at this time is to continue progress toward a balance of the federal budget.” [1]

He furthermore questioned the value of the deficit spending that had not reduced unemployment and only added debt:

“We have tried spending money. We are spending more than we have ever spent before and it does not work. And I have just one interest. … I want to see this country prosperous. I want to see people get a job. I want to see people get enough to eat. … I say after eight years of this Administration we have just as much unemployment as when we started. … And an enormous debt to boot.” [2]

Morgenthau’s warnings were not heeded, and the stock market went down 49% in a years time. They might have corrected that much even if they followed his advice, who knows. Remember that even if everything seems fine now that after the stock market has doubled remember that it can still go through yet another substantial correction.

We have not gone on for eight years yet but we have managed to accumulate more than an enormous amount of debt, and we certainly have done close to nothing of achieving anything like a reduction in unemployment. I think we have a lot of cleaning up to do, and hence a long and hard correction in the stock markets and many other asset classes, before our global economy is in a condition to return to a state of healthy sustainable growth again.

If the US was to see a repetition of 1937/38, maybe Japan could be a good place to put your money right now?

In another era and region Japan experienced and is still experiencing a prolonged economic crisis. Japan has since the Nikkei bubble burst in 1990 been through decades of stagnation, and now they have been hit with a terrible natural disaster as well. Just hours after I sent out my notice about two weeks ago the tsunami hit the Japanese coastline. The economic consequences are enormous, but like most economic crisis this one will probably be short-lived. The long-term consequences for Japan and the world are likely to be very benign. Japan has a long history of massive earthquakes and it has always quickly bounced back.

In the shorter term their economic growth rate will fall due to the massive destructions. The Japanese are likely to experience short-term inflation due to shortages caused by the loss of inventory and logistical difficulties. Despite already having the highest debt levels of any industrialized nation Japan will continue to be able to borrow money at low interest rates to rebuild its infrastructure. The latest estimate from the Japanese government puts the rebuilding costs at USD 309 billion, a little more than 5% of its GDP and by far the most expensive natural disaster in history (actual costs are likely to be even higher). After this years reduction in economic activity rebuilding activities will contribute to a great boost in economic growth that is likely to last for many years. The massive increase in borrowing needs to finance the rebuilding will likely contribute to a weakening of the Japanese Yen relative to the USD.

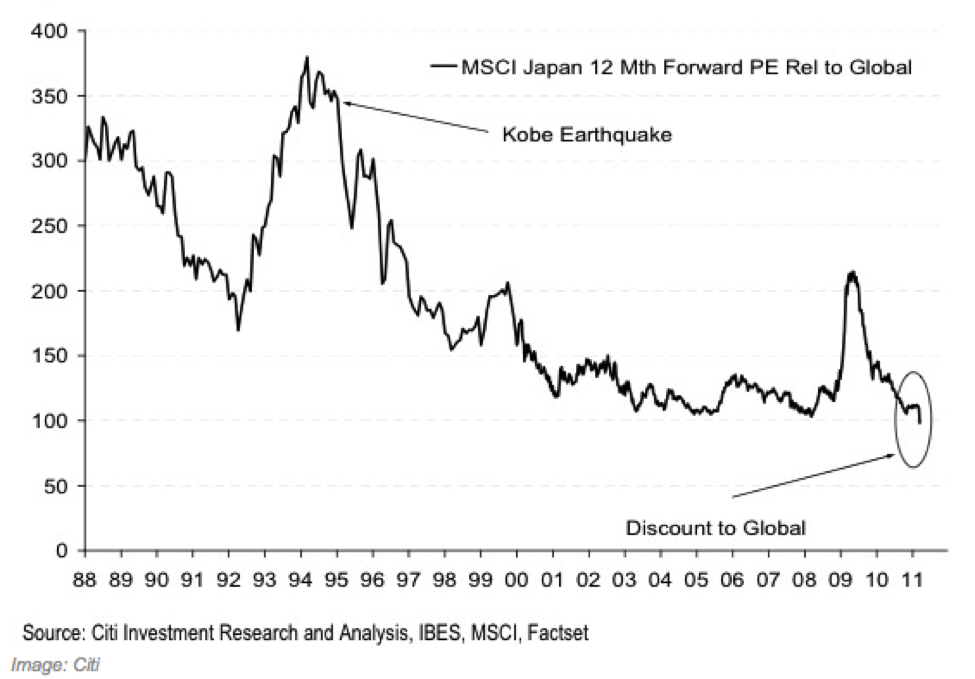

More people are now negative to Japanese stocks than ever before. Could this then be a time to actually start nibbling at some of their companies? According to Citibank and the chart below 12 month forward PE is currently at its lowest rate, and for the first at a discount, relative to global PE since the crash in 1990. Warren Buffett is just one of several renowned investors who recommend investing in Japan.

12 month forward PE relative to global PE

One of the biggest uncertainty to this investment thesis and whether or not this will be a benign global crisis is obviously dependent on what will happen with Japan’s nuclear reactors, still a big uncertainty (and reports yesterday indicated that it at the earliest will take two more weeks before the Fukushima plant can be declared safe).

Japan might or might not be nice investment, but more importantly we have so much to learn from the Japanese

What makes me a little reluctant to jump into the Japanese stock market is the situation they have been creating for themselves over the last two decades. Japanese policy making, just like we saw in the 2000s in the US, encouraged bad loans in the 1980s that helped fuel the bubble that collapsed in 1990. A 2.4% budget surplus in 1991 was turned into a deficit of 10% by 1998. Today Japan has a national debt level at around 250% relative to its GDP and it is growing! Mark my words, that debt will never be repaid.

That is not that important, at least not for us right now anyhow, it is more interesting to see how they were able to dig themselves into this hole in the first place. And we don’t need to look far to find the reason. We only need to look at what the US government and the Fed have been doing since the crash in the real estate and stock market in 2008. It seems like the US, in its despair, must have called Japan to get the recipe of failure that Japan followed after their bubble burst in 1990. What the US has done is almost a carbon copy of what the Japanese did and has continued to due until this day.

Both nations spent enormous amounts of money to bail out their financial institutions, implemented expensive programs to try to create jobs that did not have any lasting impact, and engaged in massive monetary stimuli to try to encourage increased spending. The massive spending programs did not work in Japan; and they will not work in the US or any other nation for that matter. Japanese companies decided to pay down their debt rather than to borrow, invest and expand. The US is heading in the same direction; close to zero rate policies has done nothing but funnel money into all sorts of assets classes that has created elevated prices but not contributed to long lasting economic improvements. Even the US is increasing its debt levels in record speed we are likely not to see the high levels of Japan, because the country is likely to default (and/or the economy to falter) long before any such levels are reached.

Back in January, the Congressional Budget Office estimated the fiscal 2011 deficit to USD 1.5 trillion, and that the US government will borrow 40%(!!!) of all the money it spends in 2011. On top of this they also indirectly confirmed what I have been saying for months now, that the US economy is in a terrible economic state: Tax revenues relative to GDP will for 2011 sink to the lowest level since 1950. This tells us the economy remains in a terrible funk, and that consumers who account for 70 percent of GDP are struggling.

That we don’t learn from our past mistakes is nothing new. We are not very good at it and we probably never will be. We will not learn from either Morgenthau or the Japanese, but have to do all the same mistakes ourselves as well. I guess we just want to dig a fox hole for ourselves so we have a place to hide while we blame each other for who caused of the economic mess we have created.

While the Japanese had (and still have) their lost decades, we will have our lost generation. Why is it so hard for us to accept that a period of exuberance naturally causes a period where the economy needs to cool down, where inefficiencies, too much debt and over capacity must be worked out of the system? We have been told for several thousand years that there will have to expect “seven lean years,” after the seven years of plenty. For some reason our government’s can’t accept this and our economists seem to think that they can control the market better than the market itself (and I think they enjoy the power rush of playing God with our economic lives a little bit as well). If history is any guide odds are strongly against them.

Ben Bernanke has continuously proved since he took office that he is far from the same proponent of the free market as his predecessor, Alan Greenspan, was. Most of his major actions over the last years indicate that he believes that the central bank can do much better than the market participants. (It seems like most of those participants are pretty happy with Bernanke’s job as well.) There are however endless examples throughout money’s history that proves that trying to outsmart the market does only work for so long. You can prolong the crisis but it will within a relatively short time come back and bite you even harder.

The result of the Fed’s and the US government’s decisions have been that we (the public) are left with several extra trillions of debt, but unemployment is still as high and we still face the same structural challenges that we did before all this money was spent. We are living in a way that is in no way sustainable. We will need a major fix, and that fix is not going to come until we have experienced the next major economic crisis, that we are pushing ahead of us through our current buildup of debt, which will force us make some major changes in the services we have learned to expect from our governments. We are living on borrowed time with borrowed money.

Bernanke believes that his quantitative easing (QE) potentially prevents deflation and thus averts a Great Depression 2. Japan has proven that en extremely loose monetary policy—real interest rates have been negative for ages—cannot fix all economic problems nor correct for bad policy decisions. What on the other hand the QE have resulted in so far is at least important for the velocity of money—investors are more optimistic than almost ever before.

Everybody seems to be bullish on everything right now

Betting in the same direction as conventional wisdom is the best way of guaranteeing that you will lose money in the long term. Despite the stock market having raised about 100% since it bottom out in March two years ago, it is very clear that consensus today is that the recession has ended, that equities are attractively valued and that we are in a renewed bull market. Not that there are not bearish people like myself out there, but the following data strongly confirms that the bears are in a great minority (data according to Elliott Wave):

- Individual investors (AAII poll)—most bullish in six years

- Newsletter advisors (I.I. poll 20-week average)—most bullish in seven years

- Futures traders (trade-futures.com poll)—most bullish in four years

- Mutual fund managers (% cash)—most bullish ever

- Hedge fund managers (BoAML survey)—most bullish ever

- Economists (news-org polls)—unanimously bullish

- Top global strategists (three national year-ahead panels)—unanimously bullish

- Positioning in tech stocks rose to a record high of 51%.

- Even most “bears” on the economy are bullish on stocks because of inflation!

- Oil back to above USD 100 and a strong bullish consensus has returned. Trade-futures.com reported 97% bulls on February 22 and 23. The last time it was that high was July 2. 2008, just a few trading days before the peak and crash that year. In 2008 the rationalization for the herding and high prizes was “peak oil” this it is based on the Fed’s inflation policy and on Mideast turmoil.

Here is more data suggesting that market participants are exceptionally bullish right now (from the Merrill Lynch Survey of Fund Managers dated Feb 15, 2011):

- For the first time in more than three years, investors do not predict lower global economic growth over the next 12 months.

- Investors are at their most optimistic about the global economy since December 2005.

- Institutions have record equity and commodity “overweights,” very low cash levels and the strongest risk appetite since Jan’06.

- Commodity price inflation is now rated as the largest “tail risk.” Global inflation expectations surged to 75%, highest since June’04. Consensus remains bullish on growth: just 13% expect global economy to weaken in the next 12 months.

- The FMS Risk Appetite Index rose to its highest level (47) since Jan’06. Hedge fund net exposure rose to 39%, highest since July’07. Cash balances fell from 3.7% to 3.5%, triggering our FMS cash trading rule equity sell signal.

- Asset allocation is straightforward and extreme: equity surges to a record overweight of 67%; commodities also at record overweight of 28%; bond allocation tumbles to -66%, lowest since April’06 and close to a record low.

- Massive regional rotation: exposure to EM [Emerging Markets] collapsed from 43% to 5%, the lowest level since March’09; surge in exposure to US equities (34% = second highest in past 10 years) and Eurozone (-9% to 11%).

Not much pessimism to spot here. And there are so many extreme positive ratings. An incredibly run of statistics in my opinion given the market’s mixed economic fundamentals and the already impressive run stocks have taken in the last six months.

This is something you typically observe around the top of stock markets. Not everybody remains positive, there is actually one subgroup of investors who according to Investors Intelligence are selling at its fastest pace in at least a decade: corporate insiders.

The market can off course turn around again and reach a new top, but I like to have the odds on my side when I make investment decisions and I would rather choose to invest one the same side as those making real business decisions.

The US housing market does not provide any supportive arguments for taking a positive stance regarding the future

The latest data from the US housing market strongly confirms my view that the US economy is really bad. It actually shows in bold letter that we are in a housing market depression. Almost every economic recovery in this nation’s history has been started by the housing industry. That is not happening at this time. Just the opposite (look at these numbers reported by Robert McHugh):

- Housing prices have fallen 26 percent since their peak a few years ago, the largest price decline ever in our nation, worse than what occurred during the Great Depression of the 1930’s.

- We just learned this week that New Home Sales fell 17 percent month over month in February 2011 versus January 2011.

- The gross number of New Home Sales in February 2011 annualizes to 250,000, which is the worst on record, ever. This number is less than half the number of sales in 1963, which saw 560,000 New Home sales – but with 120 million fewer people then than now live in the U.S. 700,000 is normal for a healthy economy, and the second worst number ever is 323,000. February’s number is miserable!

- Banks have tightened lending standards, making it so difficult to qualify for a mortgage that a third of all sales are now 100 percent cash deals. In other words, a third of all sales are occurring without a bank. Collateral values are sinking.

- Existing Home Sales were no better, falling 10 percent in February, with prices plunging on existing homes that get sold.

This will spread to the rest of the economy! The only thing keeping the economy afloat and positivism running high is helicopter Ben printing more money than ever in history. Whether the combination of record debt, record money printing and terrible economic fundamentals will lead to hyperinflation or a deflation leading to a depression is still an open question.

Go here to see performance and dates for previously issued newsletters.

And finally, don’t forget to read my disclaimer.

[1] Amity Shlaes, The Forgotten Man (2007) pp. 341-42.

[2] John Morton Blum, Roosevelt and Morgenthau (Houghton Mifflin, 1970) p. 256

About ewmoe:

One Response to “Newsletter #1, 2011: Market in DOWNTREND – What we can learn from Japan”

-

[...] have not sent out a newsletter for many months now, the last one was on March 25th, but I feel that the ... ewmoe.com/2011/08/07/newsletter-2-2011-last-week-was-brutal-but-what-can-we-expect-going-forward

Leave a Reply