Newsletter #11, 2010 – Market in correction from Wednesday November 17th, 2010

I have limited the number of topics in today’s issue and made it into a little story for a change:

- We are in a correction, but finally we had an uptrend that lasted more than a week

- Business leaders are positive to the US and global economy…

- …but the Fed and its disastrous last policy show signs of desperation…,

- …with likely implications being those of a currency war – the fight for being the cheapest of the lot

We are in a correction, but finally we had an uptrend that lasted more than a week

Markets do not like uncertainty, and stocks were in trouble from the start yesterday as sovereign debt fears are back on everybody’s mind again. Six months ago, it was Greece that received a bailout. Now Ireland’s debt crisis is worsening, even though they have not yet asked for a bailout. Worries that China may further raise interest rates also weighed on stocks.

With all this uncertainty combined with the negative market action we have seen lately pushed all my indicators into downtrend territory yesterday. As with all downtrends (and uptrends for that matter) there is no telling how long or deep it might be, or if it is already over. But you should be very cautious with your stock holdings now, preferably go back to cash until the downtrend has been allowed to run its course and we enter a new uptrend again. You will be properly notified here when we enter a new uptrend. Remember that successful investing involves not only making gains, but keeping them as well.

After being a little upset with the markets from April until September, I am happy to observe that we finally had a trend in the market that latest for more than a month. The market has up until yesterday been in a steady uptrend since September 2nd. The S&P 500 was up 9% during that uptrend. A decent gain in just a little over two months.

Business leaders are positive to the US and global economy…

Let’s start today’s take on the global economy by listening to some of the most known business leaders of America. Warren Buffett declared in the beginning of September that the country and world will not fall back into another recession (at least for now). “I am a huge bull on this country. We are not going to have a double-dip recession at all.” said Buffett. He said banks are lending money again, businesses are hiring employees and he expects the economy to come back stronger than ever. “The best is yet to come.”

Steve Ballmer of Microsoft said there soon will be more technological advancement and invention than there was during the Internet era, and that will help drive business growth. “I am very enthusiastic what the future holds for our industry and what our industry will mean for growth in other industries.”

The CEO of GE, Jeffrey Immelt, said…headlines are too focused on finding negative indicators. “Anger is not a strategy. Anger does not create growth. Only optimism creates growth,” he said. “Be the contrarian. Everyone is mad today. Be happy.”

The government has stated that we are officially out of the recession, but to me that is a little dubious. The reason why we came out of it is due to the stimulus and to a certain degree government fudging of their data. Just look at the continued downward revision that the government does on several of their key economic data they publish. And, as I have mentioned often, the GDP of the United States includes the stimulus spending in its results, and so makes things look better than they really are, hiding the true state of the economy. When the stimulus money left the economic system it started to reveal the state the economy has always been in – very bad.

I am still a strong believer that we will soon see that this “recovery” is not sustainable. Unemployment in the U.S. keeps going up, and more than half of the unemployed have been without a job for more than six months. More than one of every eight American, 42 million people, are now so poor that they receive food coupons. The U.S. is now much deeper in debt. The financial sector is still facing the largest risk right now, which happens to be the political risks. Politicians right now hate finance and they are likely to implement regulations that are not necessarily good for neither the economy nor the financial institutions.

So, I don’t see too many valid reasons to be overly optimistic about the economy and its ability to grow itself out of the deep hole that we are in to secure that the state of recovery is sustained. But all of those business leaders mentioned above are very smart people, run huge corporations and should have a very good feel about the temperature of the economy so its worth paying attention to what they have to say. But do also remember that business leaders are generally not good macroeconomic forecasters. In late February 2009, Buffett, in the annual report of Berkshire Hathaway, predicted, “We’re certain that the economy will be in shambles throughout 2009—and, for that matter, probably well beyond.” The media reported this conviction on March 3, 2009, three days before the bottom tick in the stock market.

Now, thanks to the optimism behind the last few months’ rally, leaders see everything as rosy. Of course, I could turn out wrong, which trust me I have been often. But if they are wrong, it will prove very costly to business people who commit precious resources to expansion just before the next phase of contraction is due.

Judging from the actions that the Fed is taking it does not look like they are too optimistic either, at least not about the current state of our affairs. Why else would they add on another USD 600 billion of Quantitative Easing (QE)?

…but the Fed and its disastrous last policy show signs of desperation…,

We were all sold on QE 1 as being an emergency measure meant to keep the financial world afloat. Now we find out that the Fed considers this formerly emergency measure to be one of its normal tools (it’s not yet been a year since QE 1 ended and we’ve already got QE lite and QE 2). Quantitative Easing is just a fancy name to used instead of what it really is, which is nothing more than printing cash from a bank (the Federal Reserve) and exchanging it for bona fide guaranteed debt obligations (U.S. Treasuries) of the United States government.

The Fed has run out of options and they are desperate to try to save the economy from falling into another recession so they print more money. Thereby also securing that the GDP at least looks good on paper. The federal deficit is in essence funded by printed dollars instead of borrowed money attached to an obligation to repay.

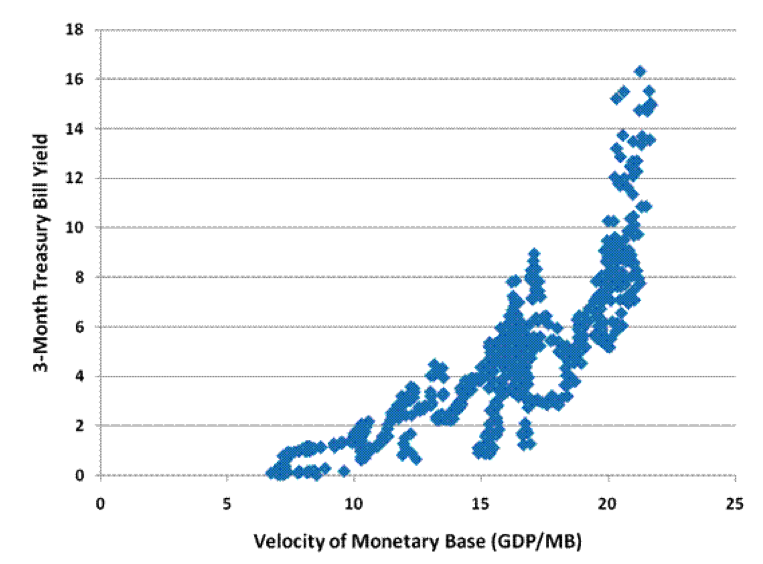

The key problem with the Fed’s aatempt to save the economy is that there is no money multiplier effect; velocity of money is not increasing. The Hussman Funds have compiled the following data (http://www.hussmanfunds.com/wmc/wmc101025.htm): “The belief that an increase in the money supply will result in an increase in (real) GDP relies on the assumption that velocity will not decline in proportion to the increase in money. Unfortunately for the proponents of “quantitative easing,” this assumption fails spectacularly in the data – both in the U.S. and internationally – particularly at zero interest rates. The chart below plots the velocity of the U.S. monetary base against interest rates since 1947.

The relationship between interest rates and velocity therefore goes flat at low interest rates, since increases in the money stock simply produce a proportional decline in velocity, without requiring any further decline in yields. Notice the cluster of observations where interest rates are zero? Those are the most recent data points.”

We can observe this lack of increased velocity by looking at bank lending, or I mean, the lack of bank lending. There has been very little increase in lending, there has been little new issuance of bonds and stocks. The stimulus money from the Fed has rather found its way into the stock market and into commodities and that is part of the reason why we have seen the market go up over the last two months (in anticipation). There is no productive purpose in QE other than to give Wall Street the liquidity to pump up financial markets at the expense of the devaluation of the US Dollar. As a general rule related to printing money in a non-growing economy: The existing dollar base will equally loose in purchasing power, the value of what is printed of new money.

The lack of velocity of money can also be observed in other parts of the economy. To me is seems like the population and corporations have already seen past the government’s bluff that the economy has recovered. Individuals have significantly increased their savings rate from slightly negative to around 6-7%. In addition, corporate balance sheets have been improved and they are now sitting on approximately USD 1 trillion of cash. This causes the economic situation for these individuals and corporations to have been significantly improved, but the money multiplier effect will remain absent as the money is not spent on consumption or investments.

The stated purpose of QE2 is to prevent inflation from dropping below the Federal Reserve’s target of 2 percent, which is somehow supposed to stimulate economic growth. I think that we have seen enough proof that the previous QEs did nothing of this sort, and I think I can pretty confidently state that this last one will do nothing like it either.

But I remain being in favor of deflation as being the most likely scenario despite this money printing, at least now for the medium term. If they however are to continue with this insane policy, calling for higher inflation sometime in the future is the world’s easiest call ever. But right now there is still too much excess capacity in the economy to create any inflationary pressures. Individuals and corporations are saving money, banks are not lending money, there is a lot of excess in all parts of the real estate sector, and in industrial production.

QE2 is a monetary policy tool being used to address a problem that has nothing to do with monetary policy. What it will do, however, is further swell the Federal Reserve’s balance sheet and lower the value of the dollar, neither of which will contribute to the long-term strength of the American or global economy. Just a little side note. QE is as I described above just another word of monetizing debt. And this is usually one of the last the last desperate measure a country will go to to stay alive, or a measure that they will use when everything else has been tried and there is no more tools in the toolbox to use. I think the US has reached that situation now. I don’t think I need to remind you that we are already borrowing money to service our interest costs?

Talking about monetizing debt and hence a swelling Fed balance sheet. But Bruce Krasting has done a very interesting analysis (http://brucekrasting.blogspot.com/2010/10/bernankes-conflict-of-interest.html) that can tell us something about what we should expect of future interest rates. He explains on his blog that the Fed contributed USD 76 billion to the federal revenue. That is according to Krasting equal to 1/3 of all corporate tax revenues! He further goes on to explain that we should not expect to see the Fed raise the Funds rate to above 3% for many years to come. The balance sheet of the Fed totals USD 2.2 trillion, which means that that the interest spread on the Fed’s portfolio is 3.45%. Every company likes to make money, and I think we can safely assume also does the Fed. If interest rates were above 3.45% they would loose money on their current balance sheet. And according to Krasting, proforma outlooks for the coming years indicate that this yield will fall to below 3%. So it might seem likely that we can assume that the Fed will continue to do whatever it can to keep interest rates low. Hmm, that sounds like we can expect QE3, QE4, and QE5 to me, but rest assured, they will probably come up with a more inventive name than that to masquerade their continued aggressive printing of new money.

Politicians are always looking to be re-elected and to find someone else than themselves to blame for all the problem that we are in. This alone is a pretty strong argument for why we will see a double dip recession, which if it is to happen, almost surly will lead to a depression.

The US has long been complaining that the Chinese have been keeping their currency artificially low (US politicians trying to blame China for our own problems). So one could argue that the massive printing of money was a response to that to try to lower the value of the USD. That might be true, but it has not been well received by the international community and there is a heated debate whether or not the economic hardships we are in will lead to another round of protectionism and also a “currency war.”

…with likely implications being those of a currency war – the fight for being the cheapest of the lot

The Chinese, Germans, Brazilians and many others have been very upset with the Fed’s decision to print more money. Germany’s finance minister, Wolfgang Schaeuble, says that the US is creating problems for the global economy. The Brazilian finance minister, Gudio Mantega, who was the first to warn of a potential currency war, said that “we all want to see the recovery of the US economy, but it will not be good for anyone to throw money out of helicopters.” Vice foreign minister of China, Cui Tiankai, is requesting an explanation for why the US needed another rounds of QE. He fears that global confidence will wither even further and hamper economic recovery.

Part of the reason for the currency wars is a result of a trading war – a lot of wars going on in the economic arena nowadays. This might just be the first step before a real war breaks out, but we will save that discussion for a later newsletter. A 1% reduction in US consumption reduced US imports by 2.9%. That shortfall in import causes exporting countries to fight for market shares on other markets and that is the reason why we are having a currency war now. Everybody is trying to weaken their own currencies to make their own products more competitive in the international market.

I am not saying that the other countries are any better than the US. China, Korea, and Japan, just to mention a few of them, are actively buying USD and selling their own currency to keep their domestic currency values low. This causes domestic products to be cheaper in the international market and stimulates exports. And Brazil has increased the tax on buying bonds and currency to prevent a further strengthening of their currency.

Currencies are relative, meaning their values move relative to each other (you can’t have the Euro, Yen and Dollar go to zero at the same time). In light of this, the Fed has officially challenged the major currencies’ central banks to a game of “devaluation chicken.” Expect to see most world central banks; especially the Bank of Japan, European Central Bank, and China’s central bank continue to engage in similar practices of their own. All of these guys have a choice, devalue or kill exports. They’ve all proven to choose the former time and again.

Such a fight for increased exports through currency manipulation would certainly lead to reduced international trade and lead the global economy into another slump, which, and I am repeating myself, will lead to a depression.

If everybody keeps printing money to force their currency values lower, the currencies will not change much relative to each other. The only thing that will happen is that the amount of total money in the system will increase, and reduce its purchasing power. And if foreigners start avoiding the USD which by itself will force interest rates up, the Fed is likely to continue to print more money to keep the interest rates low (below 3%).

It will be interesting to see what happens when Ireland asks to be bailed out. I am not saying if, because they surly need help of some sort and they might call it something else, but it will boil down to the same as a bailout no matter what. The path to true love is never smooth, and it isn’t either for the different currencies. But in all this mess, I continue to believe that, despite all of its problems, that the USD is the best of the bad lot, at least now for the medium term. Look for a continued strengthening of the USD now after the announcement of QE2.

Since you all know that I am so positive to the markets I thought I should round of today’s issue by spreading some of this optimism by a quote of David Landes from his book The Wealth and Poverty of Nations:

“In this world, the optimists have it…not because they are always right, but because they are positive. Even when wrong, they are positive, and that is the way of achievement, correction, improvement, and success.”

I totally agree with him, but make sure you choose your optimistic “battles” wisely.

Thanks for reading! Hope you enjoyed the time with me.

Until next time,

Eirik W. Moe

About ewmoe:

Leave a Reply